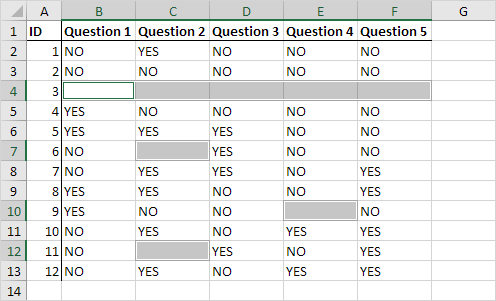

Resources have now been moved into seperate pages for paperstheses and implementations in order to keep the front page a bit more clean. Retrieved from ” https: A new spreadsheet which illustrates the differences between the reference models. Additional Resources Resources have now been moved into seperate pages for paperstheses and implementations in order to keep the front page a bit more clean. Description of the various attributes in the table Bayes – the authors use a Bayesian interpretation of the model expressing uncertainty in the prior and in their estimates.īayes – the authors use a Bayesian interpretation of the model expressing uncertainty in the prior and in their estimates. This Masters Thesis is carried out as a part of the.Īn excel spreadsheet showing the example worked in the He and Litterman paper Updated Jun 26 Information on general topics in financial blaack can be found at financialinformatics.Īll kitterman provided on this site is for informational purposes only. Technical Report at: [Accessed The Black-Litterman model. survey can be found at Black-Litterman Portfolio Construction: An Application using MatLab. No.3, Vol.4, page: 424.In this paper we survey the literature on the Black-Litterman model. Analisis Kinerja Portofolio Optimal Capital Asset Pricing Model (CAPM) dan Model Black Litterman. pub_files/sem16/s_polovenko.pdf, Accessed on 3 Maret 2020. Prosiding Seminar Nasional Matematika Jurusan Matematika UNY. Keunikan Model Black Litterman dalam Pembentukan Portofolio. Teori dan Praktik Portofolio dengan Excel.

IAIN Sultan Amai Gorontalo: Sultan Amai Press. Portofolio dan Investasi (Teori dan Aplikasi). Pasar Modal (Seri Literasi Keuangan Perguruan Tinggi). Penentuan Portofolio Optimal dengan Model Markowitz pada Saham Perbankan di Bursa Efek Indonesia, E-Jurnal Manajemen, 2(8). The stock portfolio containing the four stocks, namely ICBP, KLBF, MNCN, and TLKM with the Black-Litterman model resulted in an expected return of 2.07% and a risk of 2.82%. Four of the twenty-nine LQ45 stocks were selected as assets in the stock portfolio. The purpose of this study is to determine the stock portfolio with the Black-Litterman model using company data listed in the LQ45 stock index from January 2020 to June 2020. The Black-Litterman model of the stock portfolio is a portfolio model that involves the CAPM equilibrium return and investor views. A stock portfolio is a collection of financial assets in a unit that is held or created by an investor, investment company, or financial institution. The outbreak of Covid-19 not only threatens human lives but also disrupts various economic, financial, and business activities, especially in Indonesia. This virus infection is called Corona Virus Disease 2019 (Covid-19).

The world was shocked by the emergence of a virus that spread very quickly to several countries including Indonesia at the end of 2019. Department of Mathematics, Universitas Bengkulu, Indonesiaīlack-litterman model, expected return, portfolio, risk Abstract

0 kommentar(er)

0 kommentar(er)